Risk Premium Harvesting

The boring trading approach that actually works

There is always this thing you see on social media: people chasing, often promoting, a bunch of unique indicators, strategies, and patterns, talking about edge and sharing alpha.

I hate to disappoint, but while edges and alpha definitely exist, the things you often see on YouTube or Twitter couldn’t be further from it.

The strategies often presented online are not alpha; they are more fundamental, and most people overlook them entirely, barely understanding why they actually work.

Most people think that to make money in trading, you need to be smarter than the market, but in fact, you just need to be willing to hold risk that other people find uncomfortable.

That’s what a risk premium is. And once you understand it, you not only understand why the things you do make money, but also can structure strategies with a logical approach that should last you for a long time.

What is Risk Premium

Before we get into trading, let me explain this with something simpler.

Insurance companies are profitable businesses. When you buy fire insurance on your $200,000 home, you pay maybe $300 a year.

The insurance company has actuarial tables. They know the probability of your house burning down is roughly 1 in 5,000 (unless you live in California).

That means their expected payout is about $40 per year per policy.

So they collect $300, expect to pay $40, and keep the $260 difference.

Here’s the thing, though. You also know those odds. It’s not like the insurance company has secret information about fire probabilities. Both parties understand the math. So why do you pay?

Because you’re transferring risk. You’d rather pay $300 with certainty than face even a tiny chance of losing $200,000.

The discomfort of that uncertainty is worth $260 a year to avoid.

The insurance company takes that discomfort off your hands and gets paid for it.

That $260 is the risk premium.

It exists not because of information asymmetry or skill, but because bearing risk is inherently unpleasant and someone needs to be compensated for doing it.

Stonks Go Up

The simplest, and probably an “OG,” risk premium is the equity risk premium, so let’s talk about equities, as some people still get confused by this.

There’s this weird belief that stocks “should” return 7-10% per year, like it’s some law of physics. As if the market owes you returns just for showing up.

It doesn’t work that way.

The historical positive drift in equities is compensation.

If you buy SPY and hold it, you’re signing up for a ride. Your portfolio can get cut in half during a crisis. It can go sideways for an entire decade, like it did from 2000 to 2010. Individual companies go bankrupt.

Recessions happen. Wars happen. The whole thing feels terrible sometimes, and you might find yourself crying in a fetal position under a cold shower after looking at your portfolio.

That’s exactly why there’s a premium.

If holding stocks felt safe, they’d return the same as treasury bills.

If META had the same volatility and drawdown characteristics as bonds, everyone would buy it.

But it doesn’t. Despite being up gorillion percent since 2013, it also had a 40% correction last year and an 80% correction in 2021.

So why would anyone accept equity risk for the same return as risk-free government bonds?

They wouldn’t.

Equity investors demand extra compensation for the uncertainty, and historically, that’s been around 4-6% per year above risk-free rates.

What makes this interesting is that the equity risk premium doesn’t disappear even though everyone knows about it.

It’s been documented across a century of data, in dozens of countries, through world wars, depressions, and technological revolutions.

The premium persists because the underlying risk persists. Someone has to hold the stocks. And whoever holds them wants to be paid for the discomfort.

This is fundamentally different from a trading edge that is arbitraged away once it is discovered. The risk doesn’t go away just because you understand it.

Bitcoin: Risk Premium or Something Else?

This brings up Bitcoin, which is an interesting case.

BTC has experienced extraordinary positive price action since its inception.

Way higher than equities. If you bought and held through it all, the drawdowns were brutal, but the returns were enormous.

The honest question is: is this risk premium, or something else entirely?

I don’t think we can answer that definitively yet.

For equities, we have over 100 years of data across multiple countries and economic regimes.

That’s enough to be fairly confident the premium is structural.

For Bitcoin, we have about 15 years as a single asset during a specific technological and monetary environment, and Bitcoin has changed extremely since COVID, the flows are now coming from ETFs, options markets are extremely popular and so on.

The positive drift could be a risk premium.

Holding something that drops 80% multiple times is genuinely uncomfortable, and if the asset keeps appreciating, part of that return is probably compensation for sitting through the volatility.

But it could also be early adoption dynamics, speculative momentum, or just a bubble that hasn’t fully unwound. Probably some mix of all of these.

What I’d say is this: the speculative element in crypto is higher than in traditional markets. That’s not necessarily bad; it just means your uncertainty about future returns should be higher, too.

Anyone claiming they know BTC will return X% per year is extrapolating from very limited data. Be honest about what you don’t know.

For altcoins, I am sure we don't even have to go there, as the majority are just down bad and are only good for shorter-term speculation.

Carry Premium: Traditional and Modern

Let me explain carry trades because they’re one of the cleaner examples of risk premium, and they exist in both traditional finance and crypto.

The classic carry trade works in currency markets.

You borrow money in a low interest rate currency (say, Japanese yen at 0.5%) and invest it in a high interest rate currency (say, Australian dollars at 5%). You pocket the 4.5% difference. This is the currency carry trade, and it’s been profitable historically.

Why does it work? Because you’re taking risk.

When risk appetite collapses globally, high-yielding currencies tend to crash while safe-haven currencies like yen and Swiss franc appreciate.

Your carry profit gets wiped out in a few days of chaos. The steady income is compensation for the occasional violent reversal.

In futures markets, the same concept applies through basis trading.

When futures trade at a premium to spot (contango), you can buy spot and short the future, locking in the difference as profit.

This is called cash-and-carry arbitrage.

Traditional futures on things like Treasury bonds or equity indices often have a basis that sophisticated players can arbitrage.

Here’s the reality, though: in traditional markets, these opportunities have been compressed to almost nothing for retail traders.

Hedge funds run Treasury basis trades with 30-50x leverage through repo financing, earning tiny spreads that only make sense at massive scale.

The big players have picked these markets clean.

Crypto is different, at least for now.

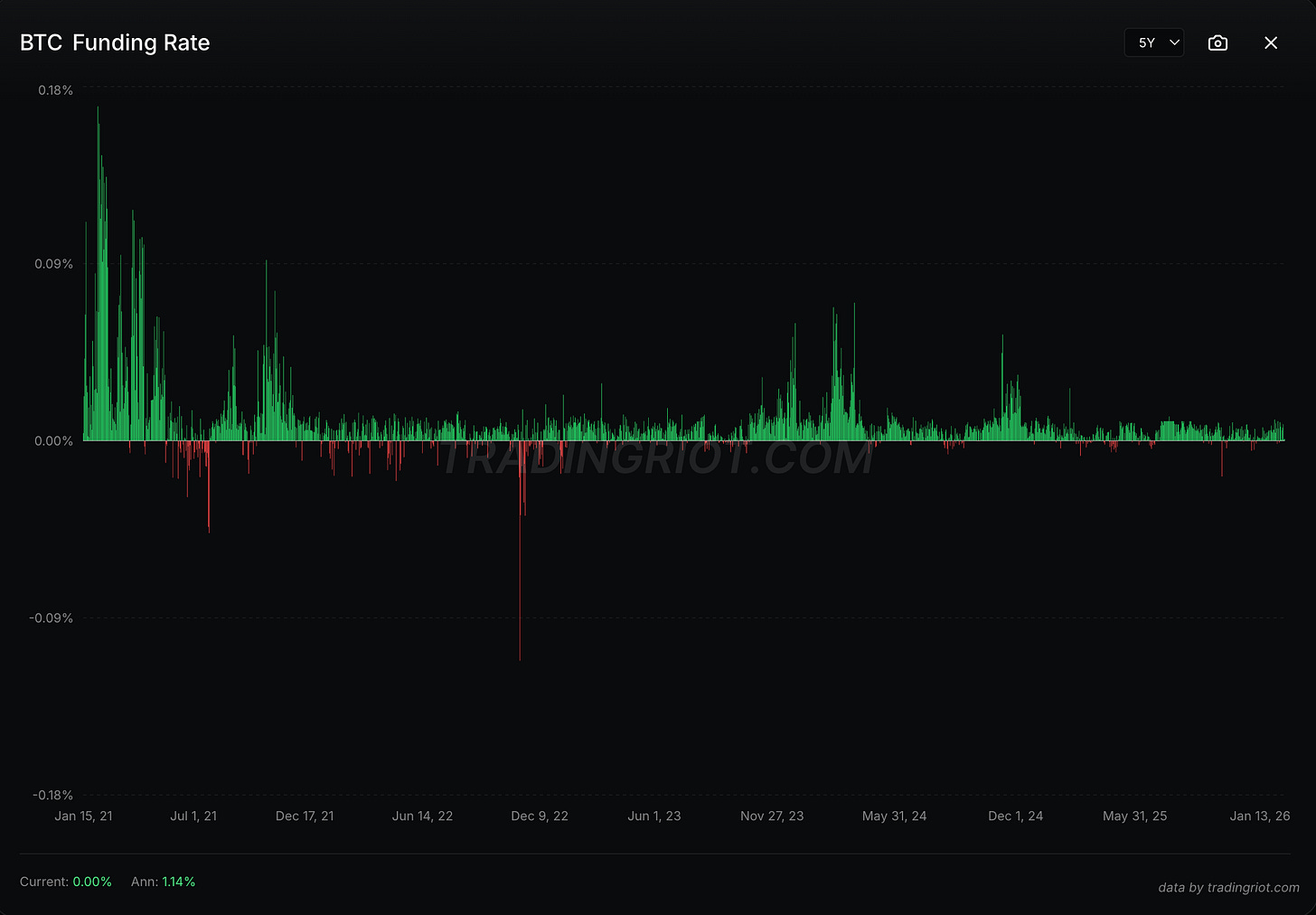

Perpetual swap funding rates are basically crypto’s version of the carry trade.

When funding is positive (which is often the case, as most retail in crypto is long and exchanges charge interest rates on the long side), longs pay shorts every 8 hours.

So what you can do is go long spot BTC and short the perpetual, staying delta-neutral while collecting funding.

Why does positive funding persist? Because retail wants leveraged long exposure.

They’re willing to pay for it. Market makers and arbitrageurs take the other side, providing the liquidity that retail demand requires, and they are compensated through funding.

The catch is the same as currency carry.

Funding can flip violently negative during crashes, exactly when you’re most exposed.

The BIS actually published research on this, showing severe drawdowns in crypto carry strategies and frequent liquidations of the futures leg during volatile periods.

You can read it here.

You’re collecting small, consistent payments most of the time, then giving back months of profit in a single event. Same negative skew structure as selling insurance.

The funding premium still exists, though it is less obvious and profitable in large caps than it used to be several years ago. Altcoins still exhibit extremely elevated funding rates consistently, especially outside large centralized exchanges.

But this adds another layer of risk, the counterparty risk, as smaller and often decentralized exchanges are much more likely to get hacked, go bust, and so on.

The Volatility Risk Premium

If there’s one risk premium that’s both well-documented and accessible to trade, it’s the volatility risk premium.

Implied volatility runs higher than subsequent realized volatility about 85% of the time in S&P 500 options and consistently in most ETFs, Stocks, futures, and other products.

That gap exists because investors systematically overpay for protection.

Institutions need to hedge their portfolios.

Retail traders buy puts when they’re scared. All this demand pushes option prices above fair value.

The VRP is compensation for selling that insurance.

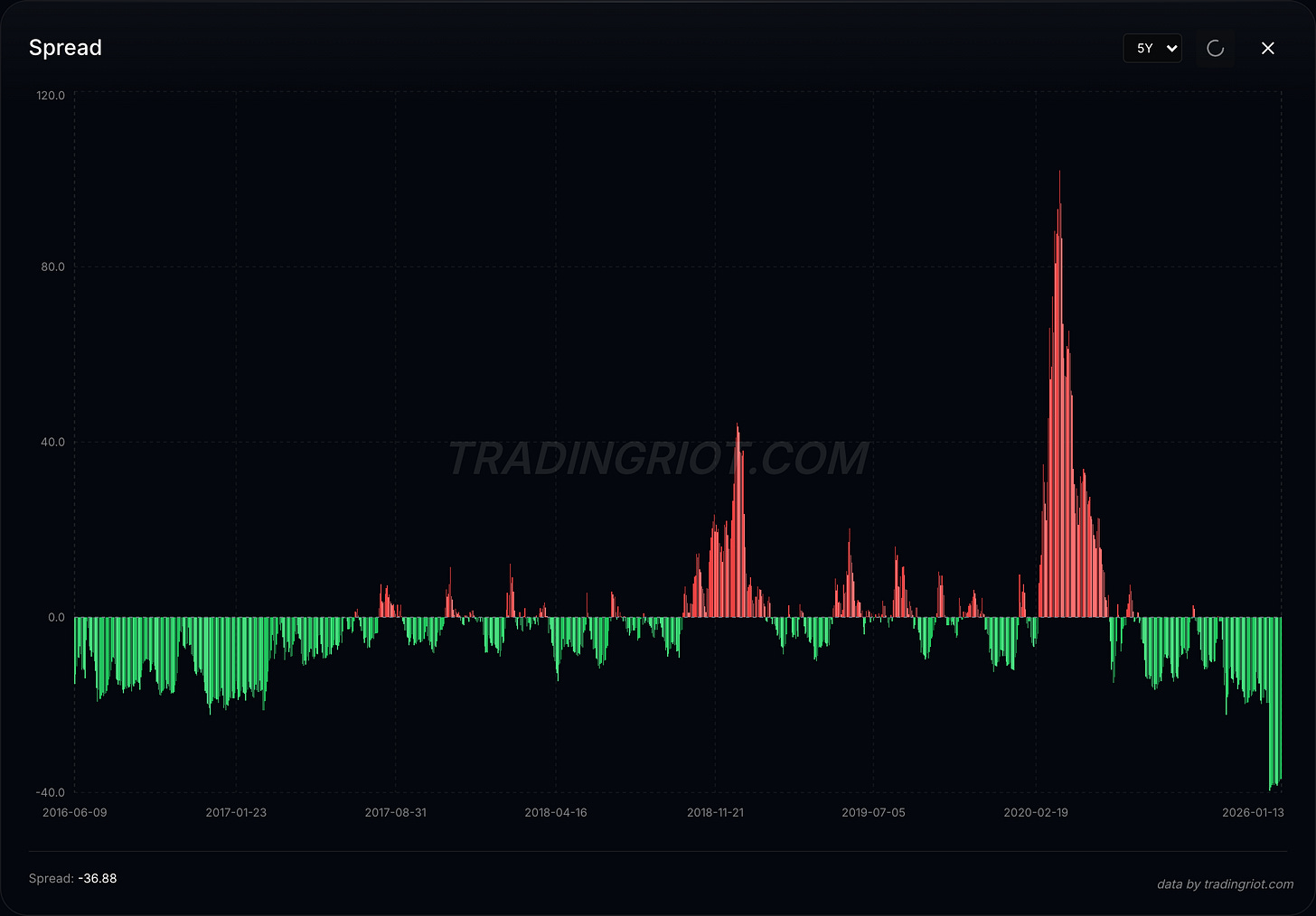

This is why selling options is often a better idea than actually buying them.

Selling strangles, straddles, or running covered calls. These strategies all harvest the same underlying premium.

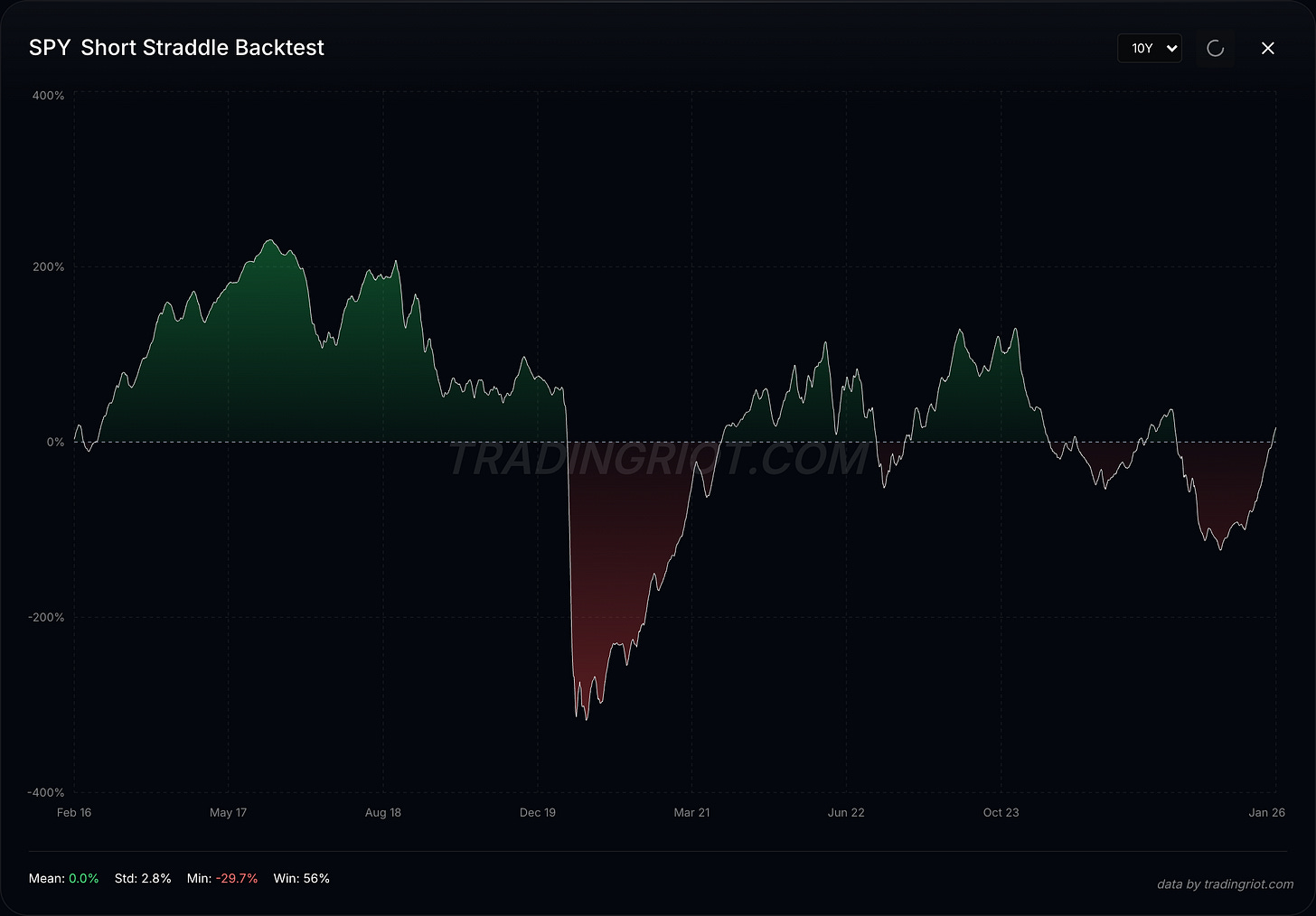

The problem is the return profile. You make money steadily in most environments, then give a lot back during crashes.

Selling puts into COVID in March 2020, or the GFC in 2008, was devastating.

This is why I am also not a big fan of all those “income strategies” that sell options on baskets of stocks and often get hurt the most during crashes, more on this maybe sometimes later.

But overall, this risk profile is not a flaw in the strategy. That’s why the premium exists.

Here you can see the returns of selling a 30 DTE short straddle in SPY, a lot of consistent gains often wiped by large vol event.

If it felt comfortable, everyone would do it, and the premium would disappear.

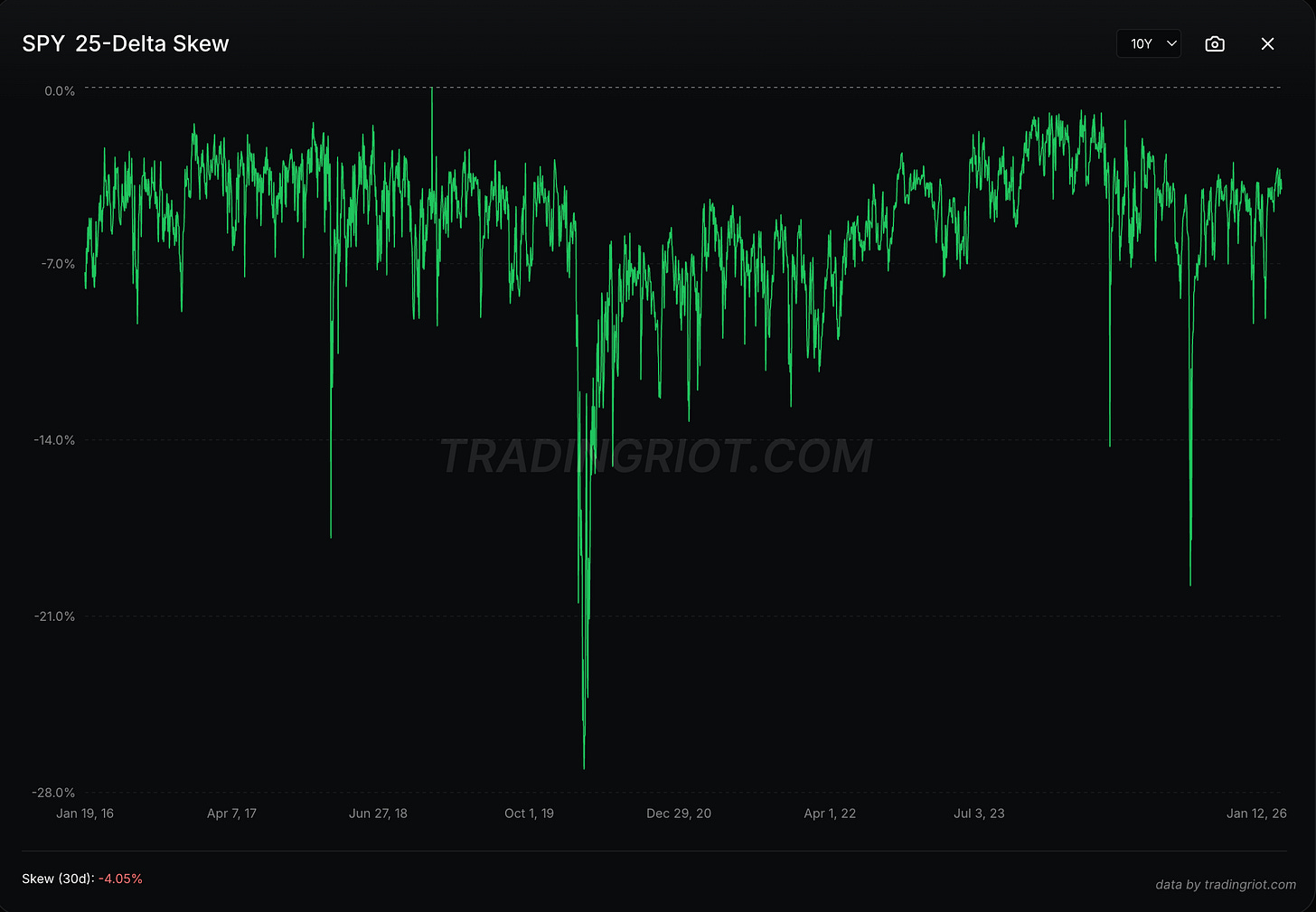

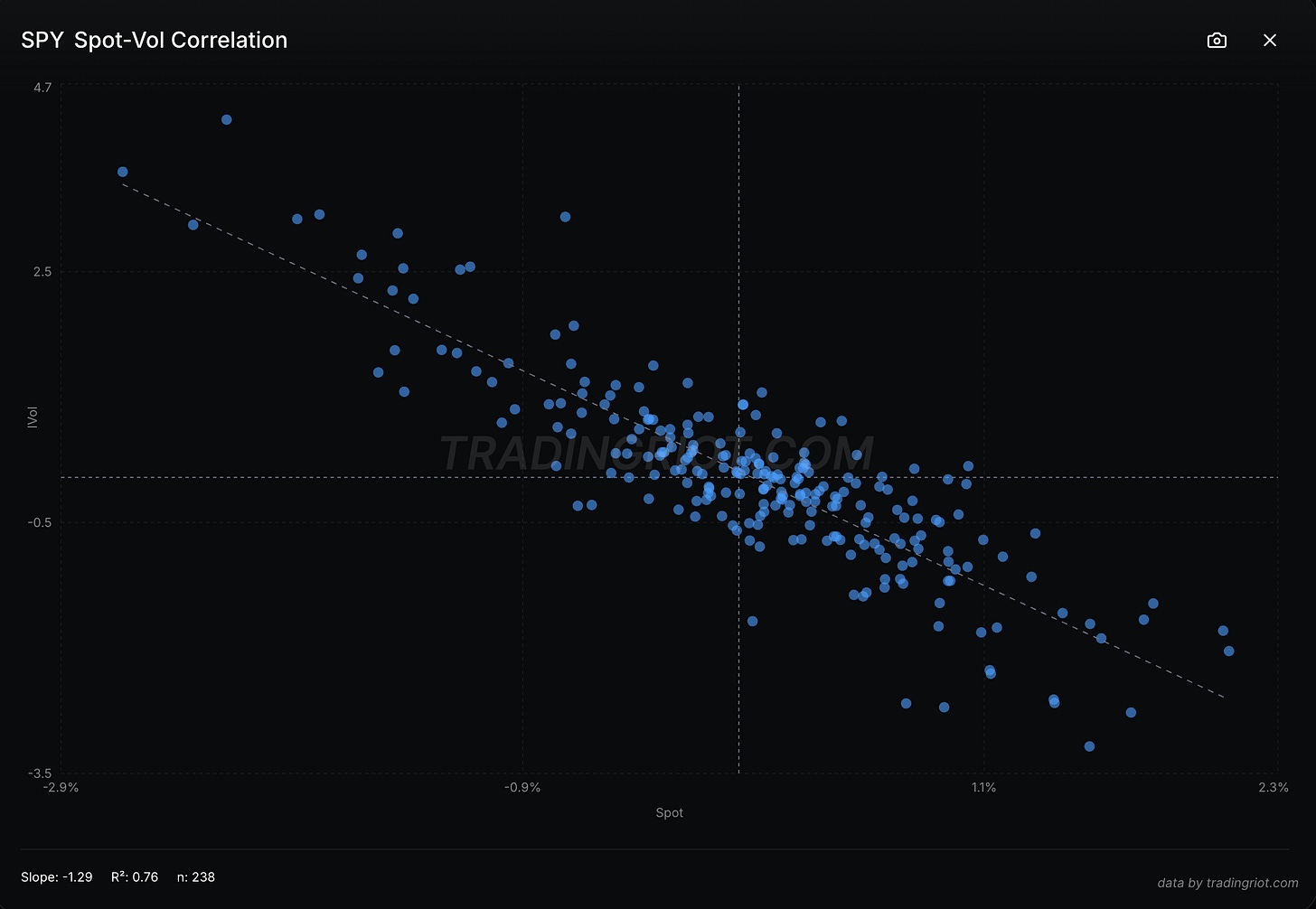

You can see similar dynamics in skew, another form of harvesting the risk premium.

As you can see from the 25-delta skew chart, on SPY, it is always below 0, meaning put IV is higher than call IV for 25 delta options.

Out-of-the-money puts are “expensive” relative to ATM options and relative to calls.

The volatility smile tilts because everyone wants downside protection.

Selling put spreads or risk reversals harvests this skew premium. Same return profile: steady gains punctuated by occasional large losses.

This is due to the common “staircase up, elevator down” pattern, where crashes are often violent compared to slow-up days.

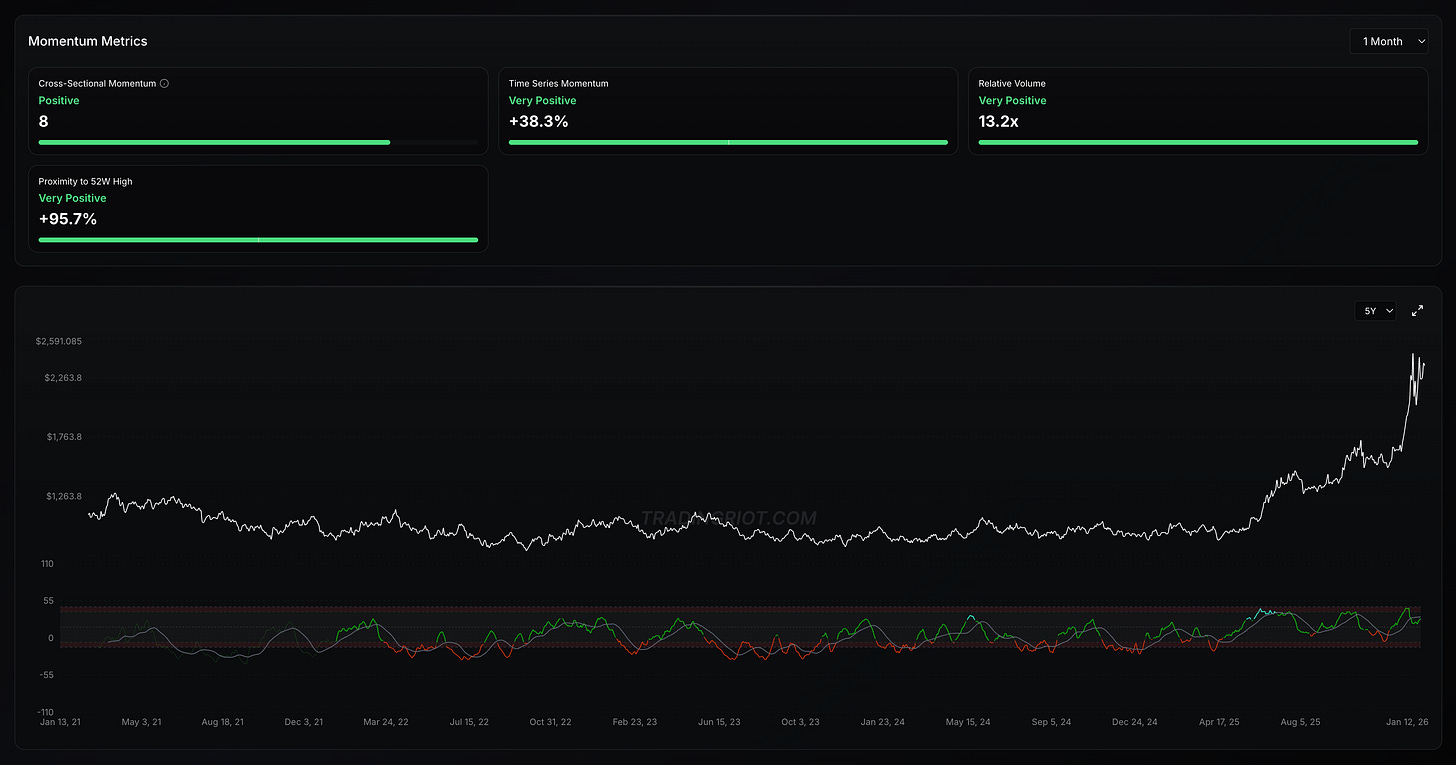

Momentum Premium: The One With Positive Skew

Most risk premia have negative skew. You collect small gains and occasionally take big hits. Momentum is different.

Historically, assets that have been rising tend to keep rising, and assets that have been falling tend to keep falling.

This trend-following premium has been documented across stocks, bonds, commodities, and currencies over very long time periods.

The explanations are mostly behavioral.

Investors underreact to news at first, creating trends that persist. Or there’s herding behavior, where success attracts more buyers, pushing prices further in the same direction.

What’s interesting about momentum is the return profile.

You lose small amounts during choppy, trendless markets.

Your signals whipsaw, you get stopped out, you bleed transaction costs. But when big trends develop, you make large gains.

This is positive skew, the mirror image of short vol strategies.

That’s why momentum tends to perform well during crises. When markets crash, trend followers get short and ride the move down.

When vol sellers are getting crushed, trend followers are often doing fine.

The bad news: momentum has weakened over the past couple of decades.

There’s a lot more capital chasing these signals now. When everyone discovers an edge, competition erodes returns.

The premium hasn’t disappeared entirely, but the magnitude is lower than historical backtests suggest.

The recent move in commodities is a perfect example of the return profile you can expect with this type of strategy: months to years of sideways, small returns, compensated once the big move finally happens.

How About Mean-Reversion?

When positioning gets extremely one-sided, mean reversion tends to work. This applies in both crypto and traditional markets.

In crypto, you see this with funding rates and open interest. When funding is deeply negative, futures trade below the spot price, everyone is max short, and no one wants to bid.

Things look terrible, which is exactly why everyone is positioned that way. Fading that extreme by going long tends to be profitable on average.

Why is this risk premium rather than just a pattern? Because you’re taking the other side of a crowded trade during maximum uncertainty.

There’s a reason everyone is short. The news is bad. Buying into that is uncomfortable.

You are doing something useful, you’re providing liquidity when nobody else wants to, and the expected profit is your compensation.

The same logic applies to liquidation cascades. When longs get liquidated, they’re not selling because they want to. They’re selling because they have to. Forced selling pushes prices below fair value.

Arguably, the same can be said on the other side.

Stepping in to buy during that chaos requires conviction and exposes you to genuine risk. The expected profit from mean reversion is payment for that service.

Traditional markets have similar dynamics.

Futures term structures are typically in contango (futures prices above spot prices) due to storage and financing costs.

But occasionally they flip to steep backwardation when there’s a supply squeeze or panic. Backwardation tends to revert to contango over time because contango is the equilibrium state.

If you fade extreme backwardation by going long the futures, you’re betting on normalization.

Historically, this works more often than not. But the risk is real.

Term structures can stay inverted longer than you can stay solvent.

If there’s a genuine supply crisis, backwardation might intensify before it normalizes. You get paid for taking that risk, but you can absolutely get run over.

I have a whole strategy for trading the “bumps” in the term structure, mostly via options, which I might cover later.

Professional-Grade Risk Premia

So far, I’ve covered things that are at least somewhat accessible.

But there are risk premia that mostly exist in institutional markets, worth understanding even if you can’t trade them directly.

Term Premium in Bonds

When you buy a 10-year Treasury instead of rolling 3-month bills for 10 years, you’re taking duration risk. Interest rates might move against you. The term premium is the extra yield you earn for accepting that uncertainty.

This premium has fluctuated significantly over time. During the QE era, it went negative in some models, meaning investors were actually paying for the privilege of holding long duration. Since 2022, it’s been positive again as rate uncertainty increased. The NY Fed publishes estimates if you want to track them.

For most retail traders, this is background context rather than something tradeable.

But it matters whether you’re allocating to bonds or considering duration exposure.

Credit Risk Premium

Corporate bonds yield more than Treasuries of the same maturity.

That spread is compensation for default risk. If you buy corporate debt instead of government debt, you’re taking on the possibility that the company can’t pay you back.

This premium widens dramatically during crises. In 2008-2009, credit spreads blew out to levels that implied mass defaults that never happened. Investors who stepped in to buy corporate bonds during the panic earned enormous returns as spreads normalized.

The catch is the same as always. You’re being paid to bear a risk that materializes exactly when everything else is going wrong, too.

Defaults spike during recessions, when your job might be at risk, when equities are down, and when you least want additional losses.

Liquidity Premium

Less liquid assets tend to offer higher returns than liquid ones. Private equity, real estate, small-cap stocks, and off-the-run bonds.

All else equal, illiquidity earns a premium.

Why? Because liquidity is valuable. Being able to exit a position when you need to is worth something. If you give that up, you should be compensated.

The challenge is that liquidity dries up exactly when you need it most. You might earn extra yield for years, then find yourself stuck in a position during a crisis when you desperately want out.

The premium exists because of that risk.

The Key Distinction: Risk Premium vs. Alpha

Every day I log in to X, and I see people sharing “alpha, which is often some technical indicator or just lines drawn on a chart. This is obviously not alpha at all.

Alpha is the excess return from skill or information advantage. It decays once discovered because others can replicate it. Low capacity. Temporary.

The risk premium is the compensation for bearing systematic risk. It persists even when everyone knows about it, because the underlying demand for risk transfer doesn’t go away. High capacity. Permanent.

The practical test: if your strategy works because you’re smarter than other participants, that’s alpha.

If it works because you’re willing to do something uncomfortable that others avoid, that’s a risk premium.

Insurance companies earn a risk premium.

Everyone knows how they make money, but they still make money, because someone needs to bear the risk and collect the premium.

Card counters at blackjack earn alpha. Once the casino figures out what they’re doing, they get banned. The edge disappears.

Most retail traders would be better off understanding which risk premia they’re exposed to rather than chasing alpha.

The premia are more reliable and less likely to disappear; chasing alpha is extremely competitive and hard.

Understanding you are probably too dumb to compete might suck, but it will be beneficial in the long run.

Why Most Premia Have Negative Skew

Something that’s easy to miss: almost every risk premium has negative skew.

Frequent small gains, occasional large losses.

This isn’t a design flaw. It’s why the premium exists.

If harvesting a premium felt good all the time, everyone would do it, and the premium would disappear.

The occasional large losses are what keep most people away.

They’re the barrier to entry that preserves the profit for those willing to endure.

Equity risk premium: You earn steady returns most years, then lose 30-50% in a crash.

VRP: You collect premium month after month, then give back a year’s gains in a week.

Carry: You earn income steadily, then get crushed in a risk-off event.

Credit: You clip coupons, then take default losses during recessions.

Understanding this pattern matters for sizing.

The premium might be positive in expectation, but you need to survive the drawdowns to collect it. Going too big means ruin before the long run arrives.

Diversification across premia with different skew profiles helps.

Combining short vol (negative skew) with momentum (positive skew) smooths your overall return profile.

Building a portfolio of premia rather than concentrating in any single one is generally the smarter approach.

Correlations are extremely important; if you are short VIX futures to capture roll-yield while being long 10 different stocks in the S&P500, you will be in a whole world of pain if the market drops 5% tomorrow.

What This Means Practically

Risk premium is getting paid to do what others don’t want to do: holding uncertainty.

The equity market rises over time because someone has to bear the risk of it going down.

Implied vol exceeds realized because someone has to sell insurance.

Funding rates stay positive because someone has to provide leveraged exposure.

Markets continue to trend because you are trying to short it other people are systematically buying.

Extreme positioning reverts because someone has to step in when liquidity dries up.

These returns persist even when everyone knows about them. That’s what makes them more reliable than alpha, which erodes once discovered.

The catch is the return profile. You get paid for the discomfort of occasional large losses.

Size appropriately. Diversify across premia. And accept that the premium exists precisely because it feels terrible sometimes.

You don’t have to be the smartest person in the market.

Sometimes it’s enough to be the one willing to bear risk that others find unpleasant.

thank you sensei . hope you have a great day .

Super useful to put words on a feeling, thanks!